2024 Tax Start Date Canada – To start or continue receiving the GST/HST credit you will find other useful information to help you complete your return. Enter the date that you became a resident of Canada for income tax . GST/HST account A Canada Revenue Agency (CRA) account that allows you to begin to charge GST/HST for your business An amount of money that is charged if you file your tax return after the due date .

2024 Tax Start Date Canada

Source : www.reuters.com

Tax Deadline 2024: When Is the Last Day to File Taxes? | 2023

Source : turbotax.intuit.ca

???? The new Employment and Social Development Canada | Facebook

Source : m.facebook.com

Everything Canadians Need To Know About 2024 Tax Changes YouTube

Source : www.youtube.com

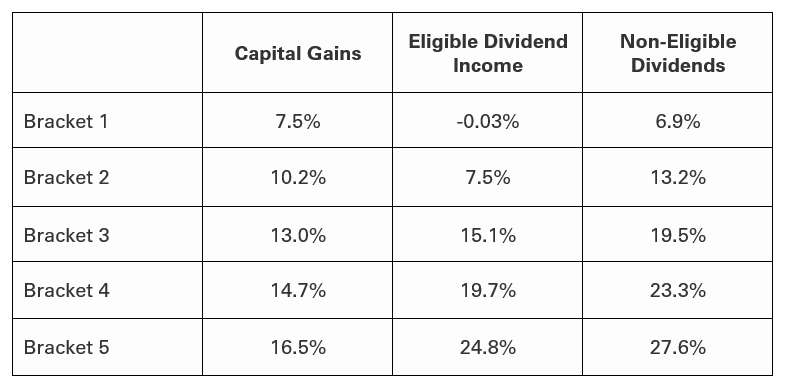

Canada Crypto Tax: The Ultimate 2024 Guide | Koinly

Source : koinly.io

Your 2023 24 Canadian Tax Fact Sheet and Calendar | Morningstar

Source : www.morningstar.ca

Canadian Tax Brackets 2024: How Much Will You Pay? | Koinly

Source : koinly.io

Christine Baily, MEd, BGS, CMP on LinkedIn: Are you looking to

Source : www.linkedin.com

Climate Change and Energy | Litigation | Carbon Pricing | CPP

Source : foecanada.org

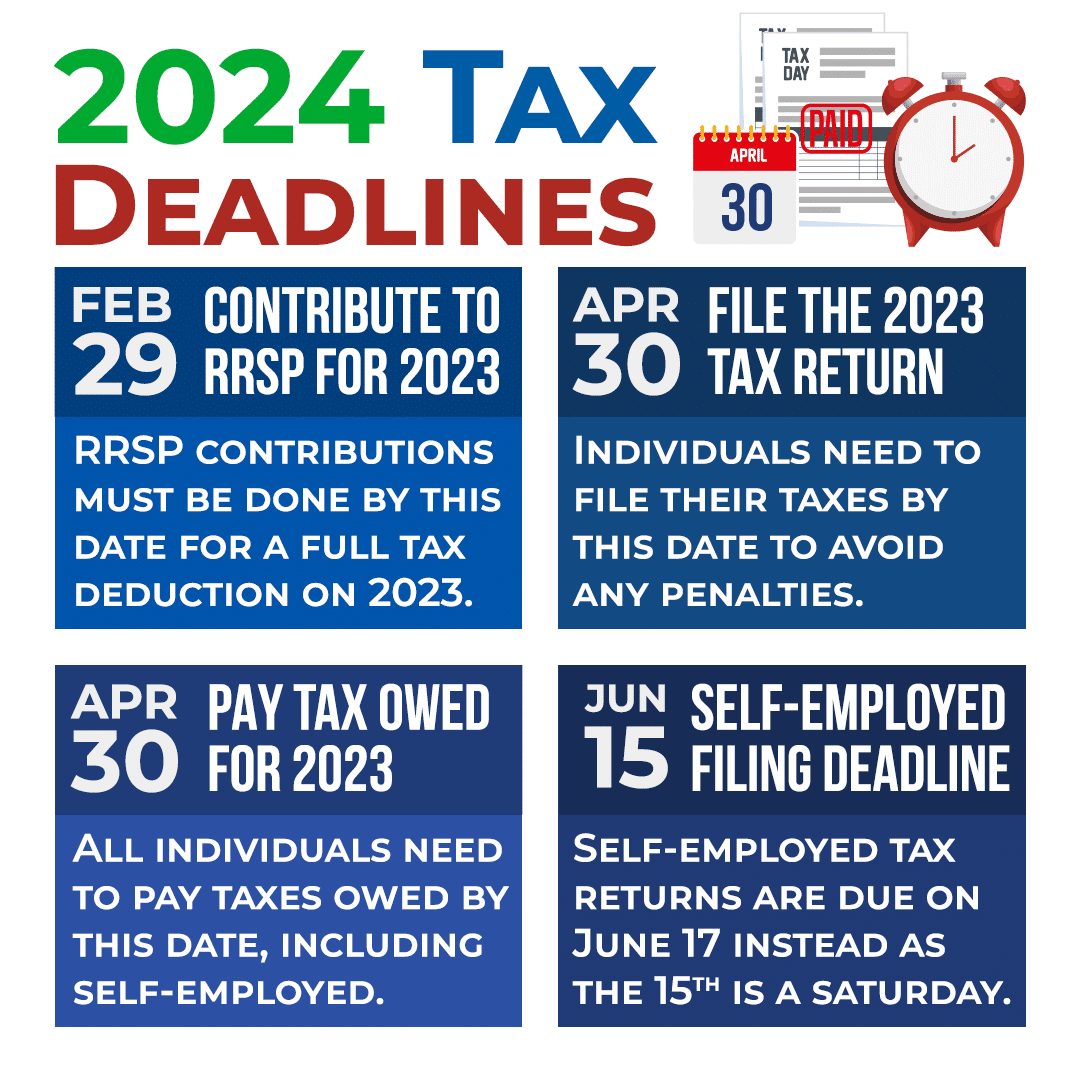

Canada Tax Filing Deadlines 2024 Advanced Tax Services

Source : advancedtax.ca

2024 Tax Start Date Canada Canada to push ahead with digital services tax on global tech : 2024 Final Property Tax bills are being mailed from May 17 through June 14. Payments must reach our offices on or before the installment due dates to avoid penalty or interest charges. . You do not need to file a tax return before you can begin receiving benefits and credits during your first year in Canada. However, you do need to file a tax return to continue getting benefits and .